We Opened Our 9 Year Old Son a Mutual Fund

One of my goals in life is to be an inspiration to other people especially those who think that they are poor and will not be able to achieve anything in life. I was born poor and without a dad as early as 9 year old but I have a BIG dream that slowly I’m putting into reality. I agree with Bill Gates that “it is not your fault if you are born poor, but if you die poor, it is.”

I made some mistakes in my financial life, and I’m hoping that my nieces and nephews will learn from it. I wrote an article last year about starting to save or better invest young because time is really GOLD. The younger you learn how to handle your finances well or invest, the more interest and money you’ll have as time goes by.

Last year, my husband and I opened a VUL account from SunLife and I’m so happy that this year I was able to open a mutual fund naman for my son. Since he’s still a minor, it’s called a Trust Fund, he’ll get that money when he reaches 18.

He got money gifts from his ninong, uncle and aunt last December and I decided to use it to open an account. I’m glad that as of now you can open a mutual fund for as low as 5,000 pesos initial investment.

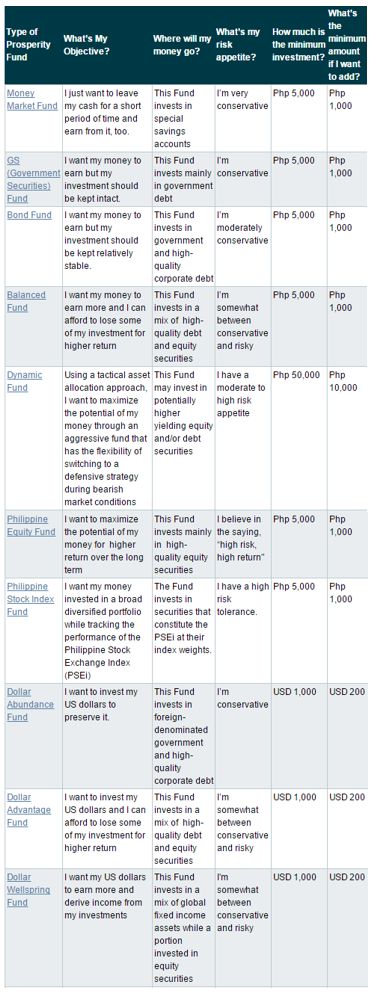

Our financial advisor gave us a lot of options to choose from. I was surprised to know that there are actually different kinds of mutual funds.

What is a Mutual Fund?

A Mutual Fund is an investment company that pools together money from different investors and invests them in various securities depending on the investment objective of the fund. The mutual fund company issues shares to the public that represents their holdings in the fund.

What are the different types of Mutual Funds available?

There are four basic types of mutual funds currently available in the market categorized according to the investment objective of the fund or the investments that the fund is primarily invested in.

- Money Market Funds invest purely in short-term (one year or less) debt instruments.

- Bond Funds invest in long-term debt instruments of governments or corporations.

- Balanced Funds invest both in shares of stock and debt instruments.

- Stock Funds / Equity Funds invest primarily in shares of stock.

How I chose the fund where my son money goes? We were asked to answer a form. In that form, there’s a corresponding number and your answer will determine if you are a conservative, moderate or risk taker investor. In every area there is a corresponding type of fund you can choose from. We are in the moderate area according to the form.

I’ve chosen the Sun Life of Canada Prosperity Philippine Index Fund, Inc.

The Sun Life Prosperity Philippine Stock Index Fund is made for investors who would like to invest in the Philippine stock market, but don’t have the time and means to do so? With the Sun Life Prosperity Philippine Stock Index (PSI) Fund, you are given access to the country’s biggest names, without consuming much time and putting in huge amounts of money. If you are looking for a worry-free investment in a broad diversified portfolio, the Sun Life Prosperity Philippine Stock Index Fund may just be the right fit for you.

I chose this because it has the smallest rate per share as of now and I’m hoping that in the long term it will get bigger.

You can choose from these selections:

But I have the capacity naman daw to change the type of fund, four times in a year. As you can see, I can top up a minimum amount of only 1,000 pesos in any time that I like (optional).

If you dream of a passive income for yourself or for your loved ones, I suggest to put your money in a trusted instrument. If you don’t like monitoring it often just like the stock market, putting it in a mutual fund is the best instrument for you. Make sure to look for a reliable company to handle your money. I still believe in not putting your eggs in one basket so its better that you have a variety of investments.

Talk to your financial advisor to help you decide.

Salamat sa pagshare mommy levy, ito ang dapat natin ituro sa ating mga anak dahil hindi naman habangbuhay ay kasama nila tayo.

Magandang idea po ito….for our love one’s future..

Yung minimum 5000 po b ay one time payment?

initial amount to open. Pero kapag hindi mo yan dinagdagan, hindi din sya lalaki. Mayron na ngayon na 1000 lang minimum

Thankyou for sharing mommy levi gnyan po ggawin sa napamaskohan ng 2kids ko open po sila ng acct pra matotoo n din po sila mg save ng mommy ☺☺

Maganda talaga to mommy. Habang bata Pa ang anak natin dapat mag ipon na tayo para sa future nya. Mas maganda yun para pag laki nya meron na syang magagamit sa kanyang pag aaral.

Thank for sharing momsh ang galing 1k pwede na makapag open ng account makapag inqiure rin para sa mga anak ko

Mukang ok nga to.. Will check more information about Sunlife 😀

Talking about financial, I definitely need this!😂 Salamat sa info po, savings lang talaga alam ko. Now I know how important mutual fund is.

xoxo

http://www.ootdbytim.wordpress.com

Wow hopefully i get to do this din next time. Im sad nagastos ko din yung mga ibang naging TF nya for his needs. Will look at this option next time. #SpreadTheLEV

this is great mom.. little man in the house has savings account too but in coop only…

Mommy I’d love to invest in something like this in the Philippines. I tried trulyrich before but they require a bank account in the Philippines which Idon’t have. Is Sunlife online or do they accept investors online or any of that sort?

Sunlife adviser need to see you in person to know you and to check what kind of investment is perfect for you.

I will ask my financial advisor about this Mutual fund. I have VUL in sunlife, but haven’t check out MF. My kids has savings account in a coop though.

yes okay din naman Coop 🙂 basta meron ayos!

This is a good move, and also teaching your kid at the early age how to save and invest – things that are not thoroughly discussed at school. Moms knows whats best.

Thanks for sharing about Sun Life’s products. I have an investment with another company, and I’m planning to make another investment for my son. I was advised not to put all my eggs in one basket so I’m actually looking around for other options. This helps a lot. 🙂

Hopefully magkaron na kami ng financial breakthrough once hubby starts to work again. And hopefully, we can not just save but also invest. Thank you for the inspiration, Mommy Levy!

Wow,thank you very po Mommy Levy Laking tulong yung info na eto sa katulad kong gusto mag impok lalo na para sa anak ko.ang ganda kasi ang daming pagpipiliang fund.Thank you very much po.❤

Fb.Noime Ortagoza

IG@noimzken

Great move, Mommy Levy! We’ve opened an insurance/mutual fund for our son, too. Mas maganda talaga maumpisahan yung investments for kids. At buti na lang, mas financially informed na ang karamihan ngayon. Most of the people are able to make wise and better financial decisions na.

Ang laki ng napamaskuhan ni Ren ha. It’s nice that you were finally able to open an account for him. Si Ykaie meron din kaya lang gusto nya na mag-ATM. Mukhang balak withdraw-hin.. LOL!

hahaha, baka gusto nya lang may name sya sa card. Parang ako dati nung bata ako pangarap ko magka credit card naman kasi ang sosyal ng dating. Nung tumanda ako nati turn off na ako sa nagamit ng card especially if ang bill ay below 500 pesos.

Great move! It’s nice to start them young. I have yet to teach the kids about finances.

This is good investment, Mommy Levy! We really have to start these kids young, teach them how to save for their future.

One of my plans too this year, for my kids. I hope I’ll be able to keep up with this goal and actually work on it, like you did.

Love the chart. It is easy to understand. I’ve been meaning to try it but I wanted to understand the whole process. This helped a lot to give me an overview. It’s good that that I can start as low as 5k. I’m a little conservative when it comes to risking the money as of now. Haha

I always believe that never put all eggs in one basket. My husband and I are trying various investments so we can add up something to our kids’ savings 🙂

My mom opened a savings account under my name as soon as I learned how to write. I was on my 5th grade when we made our first withdrawal. Super funny because my penmanship already changed that I had to update my signature specimen. If I may recommend, the book “I wish they taught money in Highschool” is a good read too.

This is a very good investment for the kids. I’ve been planning to pull out half of their savings from their junior accounts and open up a mutual fund for them. I also wanted to let them manage their own money and how investing goes. Starting them young can make all the difference…

We have a VUL with Sunlife, too – yay! I haven’t thought about getting my son a trust fund yet; in fact, it has never crossed my mind before this post. He does have a junior bank account where we put his “savings” (really, just money from my wallet that he puts inside his coin bank and money from ninongs and ninangs). I’ll look into trust funds next!

This is something we want to look into as well. But for now what we’re focusing on is saving first so that we can have enough emergency funds. After that, we’ll finally be able to think of making investments. 🙂

I also did a lot of mistake. I read about SunLife and I was planning to ask someone sana about it. Kaso the money I was saving was stolen nung nag bakasyon kami.

Gusto ko talaga mag open ng trust fund for Chelsea.

Do you have any persons to recommend Mommy Levy na pwede makausap as financial advisor.

will email you mommy

This was our original plan for my 9-year old son ~ open a mutual fund. But we are still saving to meet the minimum. Instead, we opened him a savings account for the meantime. Once we reach the needed money, we’ll go for it. I’ve learned that It is important to teach kids about financial stewardship while they are young. Great job on this Mommy Levy.

Ang swerte naman ni Ren! The ealier the better, sana as he grows older, sya na mismo magkukusa na magtop-up 🙂

Ang daming klaseng funds. I just don’t have it in me to keep tabs on them kaya na sa time deposit lang ako lagi but then it ain’t so hot na din interest-wise.

This is perfect since Hubby and I already discussed opening a mutual fund for our son. If I knew about this when I was still single, for sure malaki na ang ipon ko hehehe. Oh well.

I’ve been a crappy saver during my younger years too but I was able to open my VUL with Sunlife back in 2008. In 2015, since my Mom is with PhilamLife, I opened a mutual fund for my son with them but was not able to tap up on it. Hopefully this year I will be able to do so since I am seeing better financial standing moving forward. 🙂

Saving talaga needs to be started early. The earlier you save, the better.

My hubby and I also started through MF. Matagal tagal na research din and thankfully we were connected to TGFI family and learned that there are other (legit) investment opportunities that can give similar or more potential to our hard earn money. It’s a good start! Cheers to financial freedom! 🙂

I also opened a mutual fund for my ittle kulit last year, need to save for his future

Congrats Levy & thank you for trusting us. 🙂

Aray! Sumakit ang ulo ko sa math! LOL

But, seriously, I make sure we visit the bank every first month of the year to update their accounts. Nakakatuwa when they receive cash instead of things, diba?

I still need to learn about mutual funds. Thank you for sharing this. Pagaralan ko yan, soon! God bless:)

Good luck to growing your mutual funds with Ren. Maganda yang start.. Si Jelvin naman may bank savings account na at ayun ang ibang napamaskuhan diretso sa bank nya.

I would like to handle our finances better this year. I can save money but the biggest move that I couldn’t do is to invest. I’ve read a lot about investing and even asked one of my friends who has shares in stocks to teach me the basics. I always tell myself, “next year na talaga! ” only to realize na hindi ko na naman sya nagawa. MF talaga ang first choice ko kung magiinvest ako. The money my kids got last Christmas will be used to open a bank account for them. Thanks for sharing this. I think kailangan ko na talagang mag start mag invest this year.

time is gold, invest early for your money to grow more 🙂

This is good for children so we don’t need to keep working for them until we get old. We can work for our own enjoyment or retirement because we already have money set aside for them.

we also need to teach them how to handle money kasi mawawala din agad ang pera (especially if hindi nila pinaghirapan), if they don’t know how to handle it wisely.

It’s really important that parents become more financially wise. Mahirap na panahon ngayon! We don’t have trust funds for our kids, but we do have accounts for them in military banks (for families of men/women in service). The annual interest is around 16-18% so mas malaki kita ng money. 🙂

wow ang laki

This is such a great move. Isn’t today’s generation so blessed? The generation before them (us) had to make mistakes so we can teach them haha. I hope they see it and don’t take the opportunities for granted.